boise idaho sales tax rate 2019

A levy rate of 014 rounded to three decimals means you owe 14 of taxes for every 1000 of your propertys taxable value. This is the rate you will be charged in almost the entire state with a few exceptions.

Claim Your Grocery Credit Refund Even If You Don T Earn Enough To File Income Taxes Idaho Bigcountrynewsconnection Com

Some but not all choose to limit the local sales tax to lodging alcohol by the drink and restaurant food.

. So whilst the Sales Tax Rate in Idaho is 6 you can actually pay anywhere between 6 and 9 depending on the local sales tax rate applied in the municipality. Depending on local municipalities the total tax rate can be as high as 9. 31 rows Ammon ID Sales Tax Rate.

Idaho has state sales. This is how your levy rate is determined. If you need access to a database of all Idaho local sales tax rates visit the sales tax data page.

Blackfoot ID Sales Tax Rate. There are 19 that also charge a local sales tax in addition to the state sales tax. A recent report from the Idaho State Tax Commission shows that for a typical family of three in Boise earning 75000 per year income taxes were 3 lower than the national average sales taxes 7 lower and property taxes 26 lower.

Levy rates for 2019 in Boise were at their lowest levels in at least 10 years. The sales tax jurisdiction name is Boise Auditorium District Sp which may refer to a local government division. Be sure to keep accurate records receipts and cancelled checks documenting your payment.

Three cities follow with combined rates of 10 percent or higher. If you are not based in Idaho but have sales tax nexus in Idaho then you are only required to charge the 6 use tax rate to your Idaho buyers. 800 524-1620 Idaho State County City.

While taxing districts set their levy ratethe rate. There is no applicable county tax city tax or special tax. Contact the following cities directly for questions about their local sales tax.

Tacoma 102 percent and Seattle 101 percent Washington and Birmingham Alabama 10 percent. The Idaho ID state sales tax rate is currently 6 ranking 16th-highest in the US. In Ada County property taxes will account for 47 of the countys 2019 budget a budget that has seen a 27 increase in the last 4 years alone.

The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601. The Idaho sales tax rate is currently. Idahos state sales tax is 6.

The minimum combined 2022 sales tax rate for Boise Idaho is. How Idaho Property Taxes Compare to Other States. The average local rate is 003.

Prescription Drugs are exempt from the Idaho sales tax. Be sure to notify the Assessors Office at. The original Idaho state sales tax rate was 3 it has since climbed to 6 as of October 2006.

This can only increase each year by up to 3 plus growth. The Boise sales tax rate is. Proof of payment of property Taxes is the responsibility of the Tax payer IC63-1306.

Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 85. 4 rows The current total local sales tax rate in Boise ID is 6000. The Idaho state sales tax rate is currently.

For tax rates in other cities see Idaho sales taxes by city and county. Like most taxes Idahos property taxes are lower than the national average. These local sales taxes are often called local option taxes The cities with a local sales tax can decide which purchases are subject to the tax and at what rates.

You can print a 6 sales tax table here. The Boise County sales tax rate is. In the 2018 tax-year the property taxes collected across Idaho increased by 64 marking the highest increase in taxes paid in a decade.

Cities with local sales taxes. The 6 sales tax rate in Boise consists of 6 Idaho state sales tax. Fortunately the sales tax rate in Idaho is generally just the state rate of 6 even though certain resort towns and jurisdictions are allowed to add on an additional local sales tax rate.

FUN FACTS Several Idaho resort cities and three auditorium community center that service public need and promote prosperity security and general welfare of the inhabitants of the district districts have a local sales tax imposed in addition to the state sales tax. Average Sales Tax With Local. What is the sales tax rate in Boise County.

S Idaho State Sales Tax Rate 6 c County Sales Tax Rate. The minimum combined 2022 sales tax rate for Boise County Idaho is. Fast Easy Tax Solutions.

Among major cities Chicago Illinois and Long Beach and Glendale California impose the highest combined state and local sales tax rates at 1025 percent. Ad Find Out Sales Tax Rates For Free. Sr Special Sales Tax Rate.

L Local Sales Tax Rate. Cascade - 208. The average combined tax rate is 603 ranking 37th in the.

Sales Tax Rate s c l sr. This is the total of state and county sales tax rates. This is the total of state county and city sales tax rates.

The County sales tax rate is. Resort cities have a choice in whats taxed and can include everything thats subject to the state sales tax. Click any locality for a full breakdown of local property taxes or visit our Idaho sales tax calculatorto lookup local rates by zip code.

208-392-4415 whenever youre mailing address changes.

States With Highest And Lowest Sales Tax Rates

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Idaho Sales Tax Guide And Calculator 2022 Taxjar

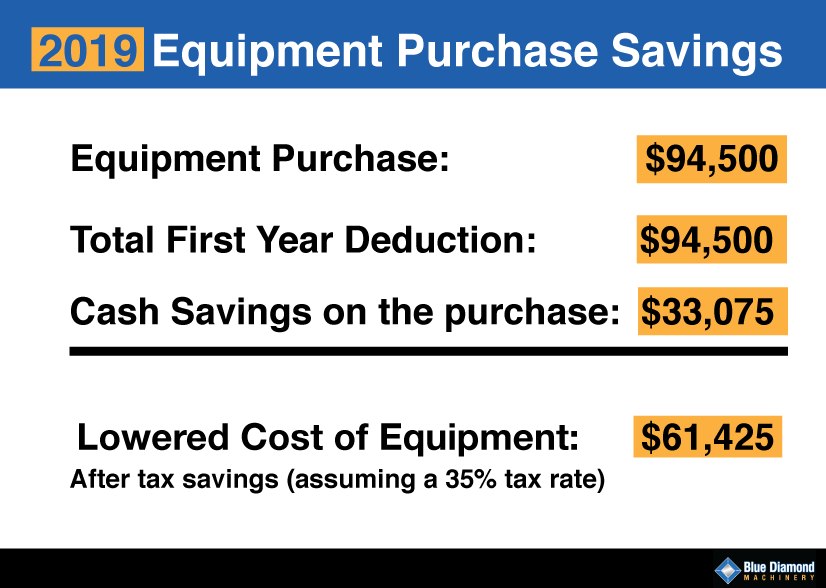

Get A Big Tax Break When You Buy Heavy Equipment News Heavy Metal Equipment Rentals

Sales Tax Rates In Major Cities Tax Data Tax Foundation

States With Highest And Lowest Sales Tax Rates

This Is The Most Expensive State In America According To Data Best Life

Texas Taxable Services Security Services Company Medical Transcriptionist Phone Service

Idaho Gop Wants To Eliminate Property Taxes For Some Residents Increase Sales Tax Politics Magicvalley Com

What S This Wayfair Fund I Keep Hearing About Idaho Reports

Idaho S Grocery Sales Tax Is An Issue At Every Legislative Session Have Thoughts Let S Talk Idaho Capital Sun

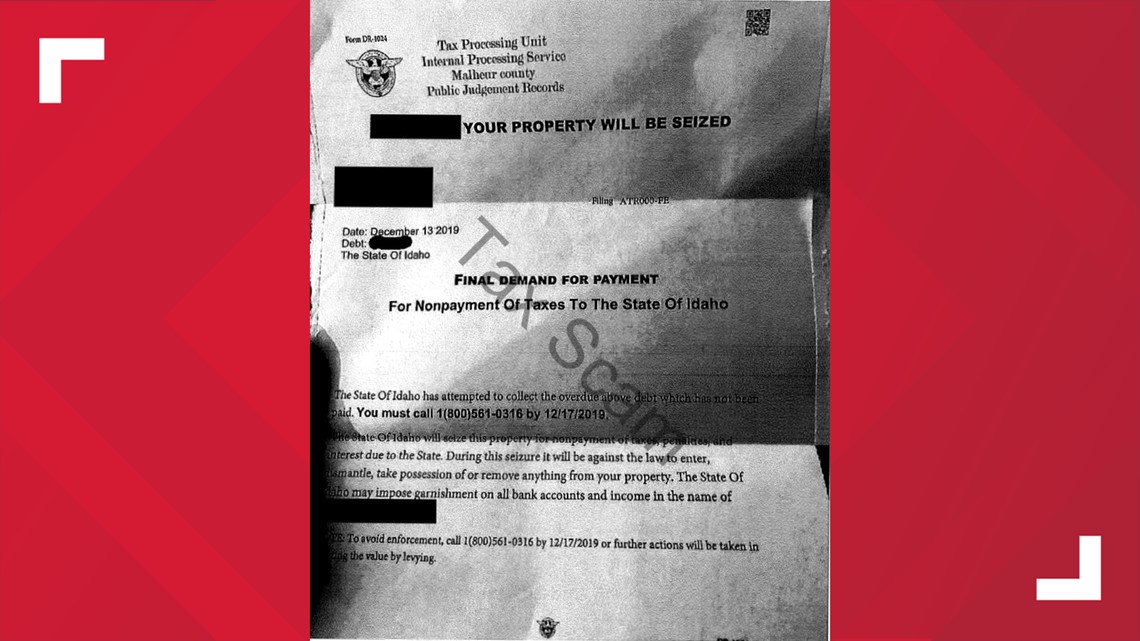

Idaho Tax Commission Renews Warning About Fraudulent Mailings Ktvb Com

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Are California S Taxes Really That Bad R California

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Total Sales Tax Per Dollar By City Oklahoma Watch

Idaho House Passes 600 Million Income Tax Cut And Tax Rebate Bill Idaho Capital Sun

Rustic Acres 608 North Empress Street Mobile Home For Sale In Boise Id 1098574 Mobile Homes For Sale Rustic Mobile Home