alabama tax lien laws

If the state buys the tax lien the property can be redeemed whenever it is due before it leaves the state. In the event another party purchases the lien you can redeem the property at any time during three years following the date of sale of the property.

Government Tax Lien Certificates And Tax Foreclosure Sale Properties

Search Tax Delinquent Properties.

. In the event this lien does not get paid the investor could foreclose it to gain ownership of the property. One option is to buy tax delinquent properties from the state of Alabama. Just remember each state has its own bidding process.

See Alabama Code 1-1-1. The winning bidder at an Alabama tax sale is the bidder with the greatest bid. Transcripts of Delinquent Property.

While it might be a financially wise choice it is more complex from a legal perspective than you might imagine. For the vast majority of Alabama Counties tax liens are sold at auction once a year but more importantly the Alabama Department of. It will go into effect on October 1 2021.

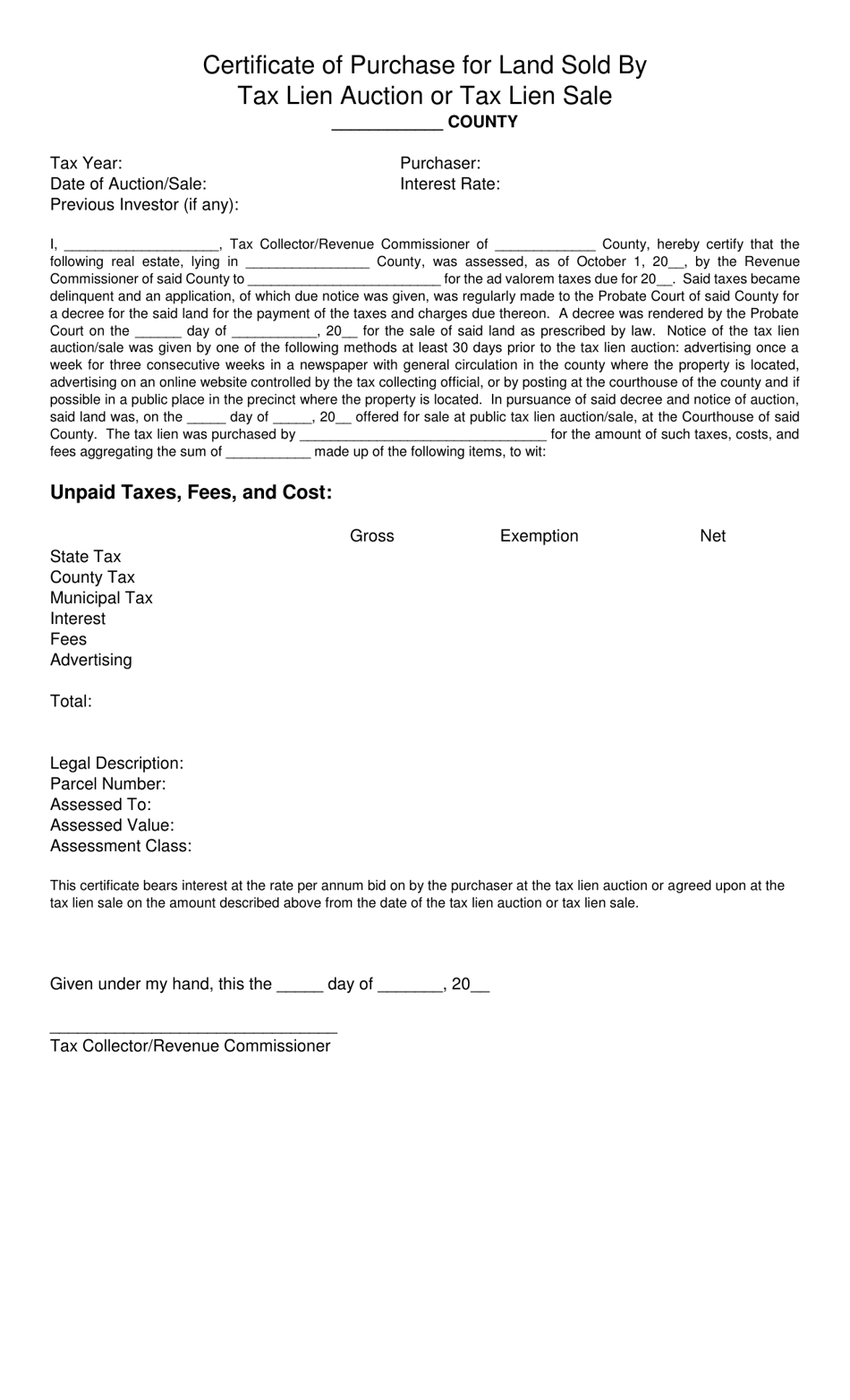

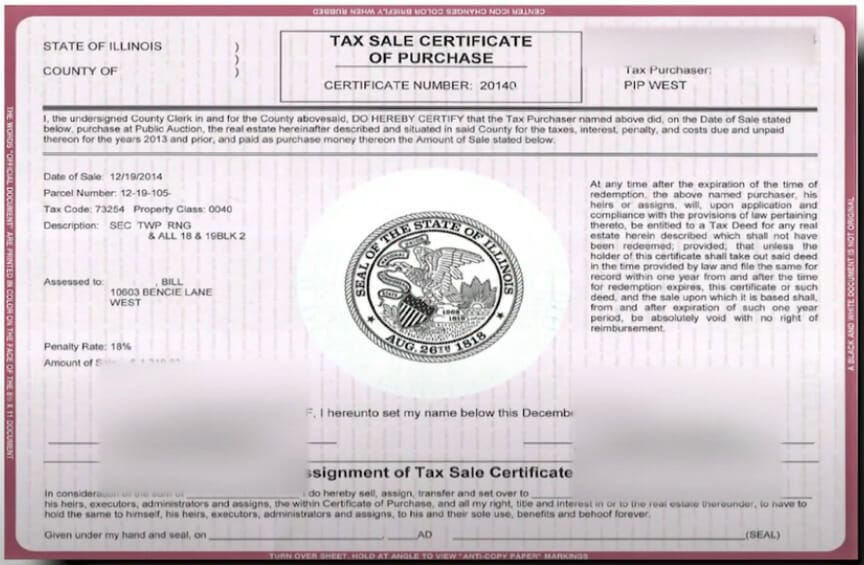

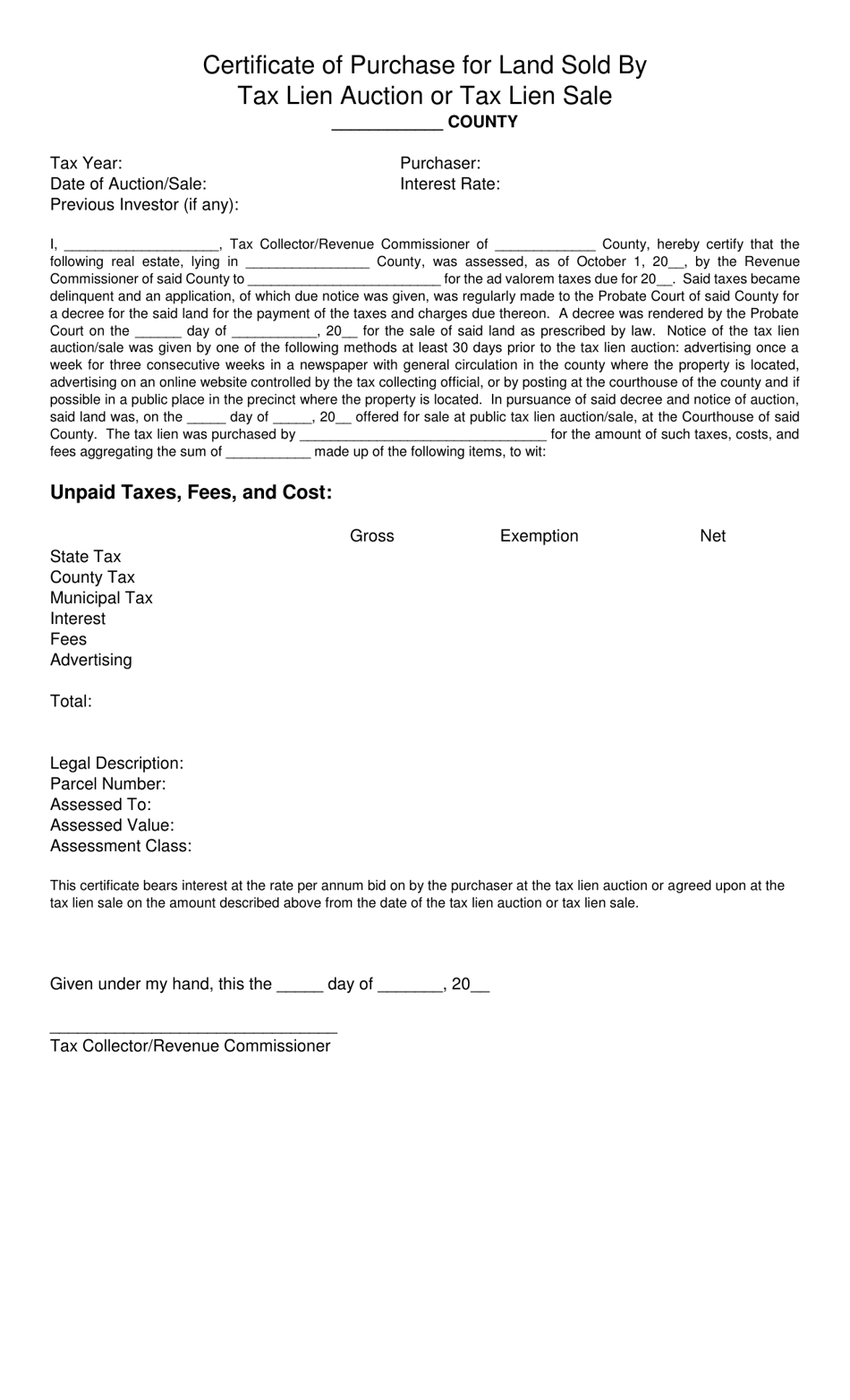

What Are The Alabama Laws Regarding Tax Liens Against Property. Financial Institutions Excise Tax. B A tax lien certificate shall evidence the auction or sale or assignment to the holder of the tax lien certificate of the delinquent and unpaid taxes penalties interest fees and costs set forth therein and represented by the tax lien.

Alabama is a hybrid tax lien certificatetax deed state but a few counties have moved to tax certificate lien only. C A tax lien certificate shall bear the interest rate per annum as bid on by the purchaser at the tax lien auction or as agreed upon by. Additional information can be found in the Code of Alabama 1975 Title 40 Chapter 10 Sale of Land.

Code 40-10-120. Below is a listing by county of tax delinquent properties currently in State inventory. Section 35-11-70 - Lien on stock for pasturage or training.

Senate Bill 140 House Bill 329 was signed into law by Governor Ivy on April 1 2021. Financial Institutions Excise Tax. ALSSA will be hosting a lunch and learn on Sept 22 2021 with Scott Zucker ESQ to explain the new changes.

In Alabama taxes are due on October 1 and become delinquent on January 1. Alabama tax lien certificates are sold at County Tax Sales during the month of May each year. 1321 1 Section 8-15-31.

The transcripts are updated weekly. AL Code 40-10-187 2016 Section 40-10-187 Tax lien certificate. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Alabama Business Privilege and Corporation Shares Tax of 1999. The reason I capitalized MAY COUNTY will be evident when you read the Bill. A new owner may redeem the lien immediately following any sale if they have made a claim to the loan that was made.

Alabama Tax Lien Sales. If you are considering buying a tax delinquent real estate property contact a Birmingham real estate lawyer. Section 35-11-71 - Lien on birds or animals for feeding boarding or training.

Section 35-11-72 - Lien of landlord on stock raised on rented premises. Alabama Tax Lien Certificates. View How to Read County Transcript Instructions.

In Alabama if the state buys the tax lien the property may be redeemed at any time before the title passes out of the state. Once there is a tax lien on your home the taxing authority may hold a tax lien sale. Article 5 Liens of Particular Persons or Classes of Persons.

Estate and Inheritance Tax. Alabama law grants redemption rights to all persons or entities having an ownership interest in the property or who hold a mortgage or lien on the property at the time of the tax sale20 Alabama. For purposes of this article the following words and phrases shall have the respective meanings ascribed by this section.

On March 8th 2018 the Alabama House of Representatives unanimously passed HB354 that MAY drastically change tax lien laws in your COUNTY. Dont Let that Lien Hold Back Your Financial Future. The bidding begins at just the back taxes owed.

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. If this 6-month period passes without an action being filed to enforce the lien the lien expires. This period is the same time period in which a prime contractors lien must be filed.

Ad Affordable Reliable. A The tax collector shall make execute and deliver a tax lien certificate to each purchaser at the tax lien sale or to each assignee thereafter and shall collect from the purchaser or assignee a fee of one dollar 1 for each tax lien certificate. The tax lien market in Alabama is active year round by wholesalers direct purchase from the state and flips.

Tax liens in Alabama if purchased by the state may now be redeemed at any time before their owner leaves the state. Get Your Options Today. Where a public entity arranges to pay suppliers including suppliers to the contractor and subs directly in order to avoid paying sales tax if the public entity fails to pay the suppliers may bring a claim on the payment bond.

Trusted Methods Excellent Tax Team. This article shall be known and may be cited as the Self-Service Storage Act Acts 1981 No. Division 1 Agisters or Trainers.

If another party buys the lien you may redeem the property at any time within three years from the date of the sale. Again if you dont pay your property taxes in Alabama the delinquent amount becomes a lien on your home. Alabama is a tax lien state.

To defeat owner must object to services or materials. Estate and Inheritance Tax. The original owner has 3 three years to redeem his or her interest in the property.

If you do not see a tax lien in Alabama AL or property that suits you at this time subscribe to our email alerts and we will update you as new Alabama. Lien for full amount of materials regardless of whether value of materials exceeds unpaid balance due by owner to general contractor. New lien law begins October 1 2021.

Check your Alabama tax liens rules. Section 35-11-60 - Lien declared. Newman Bros Inc 288 So2d 749 CtAppAla.

Tax liens offer many opportunities for you to earn above average returns on your investment dollars. In a tax lien state a priority lien against the property is sold to an investor giving the investor the right to collection the back due taxes and earn interest. Alabama mechanics lien law requires that a mechanics lien be enforced within 6 months from the date the entire amount became due.

The Alabama Senate has a companion Bill SB261 that is waiting on the call of the chair to bring the Bill to a vote.

Arkansas Billofsale Bill Of Sale Template Word Template Professional Templates

Faq Alabama Tax Sale Investing Youtube

Make Money With Tax Liens Know The Rules Ted Thomas

Investing In Tax Liens Is It A Good Idea Alabama Real Estate Lawyers

Alabama Certificate Of Purchase For Land Sold By Tax Lien Auction Or Tax Lien Sale Download Printable Pdf Templateroller

Alabama Application For Vintage Vehicle License Plates Mvr 40 12 290 Car Title Vintage Cars Boat Trailers

Alabama Tax Sales Tax Liens Youtube

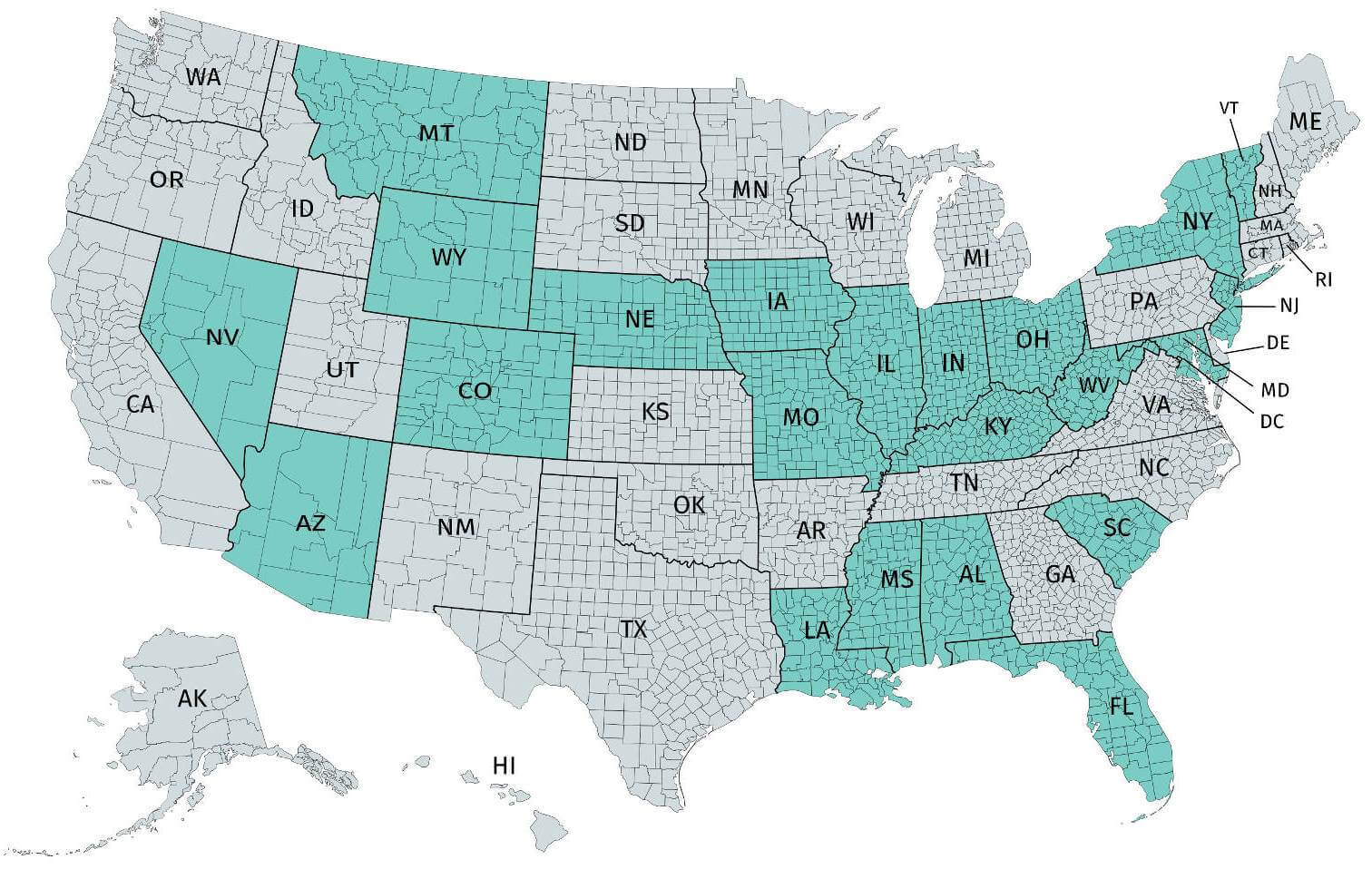

A Guide Through The Tax Deed States Are They Legal

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas